In our increasingly connected world, India stands at the forefront of digital transformation. From online banking to e-commerce, and social media to digital payments, technology has woven itself into the very fabric of our daily lives. While this brings incredible convenience and opportunities, it also opens new doors for cunning cybercriminals. As we look towards 2025, these fraudsters are becoming more sophisticated, using advanced tactics to trick unsuspecting individuals. Understanding their tricks is your first and best line of defense. Let’s understand Top 10 Cyber Scams in India.

This article will pull back the curtain on the most prevalent and evolving cyber scams targeting people across India. We’ll explore how these scams work, why they’re so effective, and most importantly, how you can protect yourself, your loved ones, and your finances from falling victim. Staying informed is no longer just an option; it’s a necessity in the digital age.

Table of Contents

Key Takeaways

- Scammers are Evolving: Cybercriminals are using advanced technology, including AI, to create more convincing and personalized scams.

- Common Tactics Persist: Phishing, job scams, and investment frauds remain rampant, often exploiting trust and the desire for quick gains.

- Your Data is Gold: Scammers primarily target personal information (KYC details, OTPs, passwords) and financial credentials.

- Verify Everything: Always double-check unexpected calls, messages, or emails, especially if they ask for money or personal data.

- Strong Digital Hygiene is Key: Using strong passwords, two-factor authentication, and being cautious online are your best defenses.

The Rising Tide of Cybercrime in India

India’s rapid digital growth has unfortunately been accompanied by a surge in cybercrime. According to various reports, the financial losses due to online fraud are in the thousands of crores annually, affecting millions of citizens. These aren’t just isolated incidents; they’re part of a massive, organized criminal enterprise that preys on vulnerability and a lack of awareness.

The landscape of cyber scams is constantly shifting. What worked yesterday might be tweaked today, or entirely new methods might emerge tomorrow. That’s why staying updated on the latest threats is crucial. Let’s dive into the top 10 cyber scams that are expected to dominate the Indian digital landscape in 2025.

Hear is the List of Top 10 Cyber Scams in India

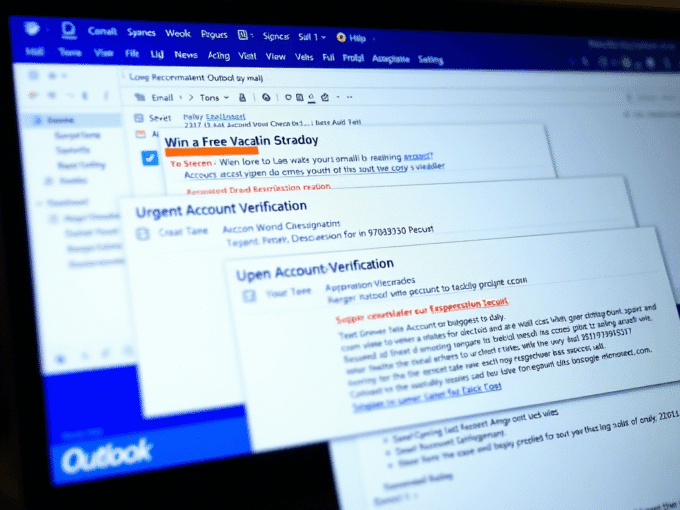

1. Advanced Phishing, Smishing, and Vishing Scams

Phishing, in its various forms, remains the undisputed king of cyber scams. In 2025, expect even more sophisticated attacks.

- Phishing (Email): Scammers send fake emails that look exactly like they’re from banks, government agencies, e-commerce sites, or even your workplace. These emails often contain urgent warnings about account issues, package deliveries, or tax refunds, prompting you to click a malicious link. The links lead to fake websites designed to steal your login credentials or personal information.

- Smishing (SMS): You receive text messages with similar urgent pleas, often with short links. These might pretend to be from your bank about a suspicious transaction, a delivery service, or even a friend in distress. Clicking the link can install malware or take you to a fake login page.

- Vishing (Voice/Call): Criminals call you, impersonating bank officials, police, government agents, or tech support. They might claim your account is compromised, your KYC needs updating, or that you’ve won a lottery. They then try to trick you into revealing OTPs, card details, or even transferring money.

Never trust an unsolicited call or message asking for personal financial information. Banks and legitimate organizations will never ask for your PIN or OTP over the phone or SMS.

How to avoid: Always verify the sender’s identity through official channels (e.g., call your bank’s official number, not the one provided in the message). Be wary of urgent language and unexpected requests. To strengthen your defenses against these attacks, it’s vital to strengthen your phishing defence mechanisms.

2. Sophisticated Job and Employment Scams

The promise of a lucrative job is a powerful lure. Scammers exploit this by posting fake job advertisements on popular job portals, social media, and even through direct messages.

- The Modus Operandi: They offer incredibly high salaries or work-from-home opportunities with minimal effort. After initial contact, they might ask for an “application fee,” “training fee,” “background check fee,” or even insist you buy specific software or equipment from them. They might conduct fake interviews or send impressive-looking “offer letters.”

- Emerging Trend: Some advanced job scams now involve asking victims to perform small, paid tasks (like liking YouTube videos or reviewing products) to build trust, only to later demand a large “investment” for higher returns, which then vanishes.

How to avoid: Never pay money for a job offer. Research the company thoroughly. Check their official website and reviews. If it sounds too good to be true, it probably is.

3. High-Return Investment and Cryptocurrency Scams

With the growing interest in digital assets, investment and crypto scams are booming.

- The Lure: Scammers promise unbelievably high, guaranteed returns on investments, often through fake apps, websites, or social media groups. They might pose as financial advisors or crypto experts.

- The Trap: Victims are encouraged to invest small amounts first, which might even show initial “returns” to build confidence. Once a larger sum is invested, the platform disappears, or withdrawals become impossible. They might even use deepfake technology to create fake celebrity endorsements.

How to avoid: Be extremely skeptical of guaranteed high returns. Research any investment platform thoroughly. Consult a trusted financial advisor. Remember that legitimate investments always carry risks.

4. Tech Support Scams

These scams involve criminals posing as technical support representatives from well-known companies like Microsoft, Apple, or internet service providers.

- The Approach: They might call you directly, or a pop-up warning on your computer screen might trick you into calling them. They claim your computer has a virus, malware, or other critical issues.

- The Deception: They convince you to grant them remote access to your computer. Once they have access, they pretend to fix non-existent problems, install actual malware, or steal sensitive data. They then demand a hefty fee for their “services.”

How to avoid: Legitimate tech support companies will not cold-call you about a problem with your device. Never grant remote access to your computer to an unsolicited caller. If you suspect an issue, contact the company directly using their official contact information.

5. Online Shopping and E-commerce Fraud

With the rise of online shopping, fake websites and fraudulent sellers are increasingly common.

- Fake Websites: Scammers create professional-looking e-commerce websites that mimic popular brands, offering products at unbelievably low prices. Once you pay, you either receive a counterfeit item, nothing at all, or your payment information is stolen.

- Social Media Scams: Ads on social media often lead to these fake sites or to individual sellers who disappear after receiving payment.

- Non-Delivery/Wrong Product: You order a genuine product from a seemingly legitimate seller, but receive something entirely different, or nothing at all.

How to avoid: Always check the website’s URL for legitimacy (look for “https://” and a padlock symbol). Read reviews, especially external ones. If the price is too good to be true, it probably is. Use secure payment methods.

6. KYC Update Scams

“Know Your Customer” (KYC) is a mandatory process for banks and financial institutions. Scammers exploit this by impersonating banks, telecom providers, or even government bodies.

- The Threat: You receive a call or message stating your bank account, SIM card, or wallet will be blocked if you don’t update your KYC immediately.

- The Demand: They then ask for sensitive personal information, OTPs, or trick you into downloading a remote access app, allowing them to gain control of your device and empty your accounts.

How to avoid: Banks and legitimate entities will never ask for your PIN, OTP, or full card details over the phone or SMS for KYC updates. Always visit your bank branch or use their official app for such procedures. For more comprehensive protection, learn how to protect your account from password leaks and data breaches.

7. Loan and Grant Scams

These scams target individuals or small businesses desperate for financial assistance.

- The Promise: Scammers offer easy loans or government grants with no credit checks, often advertising through social media or direct messages.

- The Catch: They demand an “advance fee,” “processing fee,” “insurance fee,” or “tax” before the loan can be disbursed. Once the fee is paid, the loan never materializes, and the scammer vanishes.

How to avoid: Legitimate lenders do not ask for upfront fees for loan processing. Always apply for loans through official banks or registered financial institutions.

8. Romance and Dating Scams

These emotionally manipulative scams target lonely individuals seeking companionship online.

- The Build-Up: Scammers create fake profiles on dating apps or social media, building a strong emotional connection with the victim over weeks or months. They often claim to be professionals working abroad or in the military.

- The Ask: Once trust is established, they concoct a story involving a sudden emergency – a medical crisis, a business failure, travel issues, or customs problems – and ask for money. They promise to repay, but of course, never do.

How to avoid: Be cautious of online relationships that move too fast or where the person avoids video calls. Never send money to someone you’ve only met online, no matter how compelling their story.

9. QR Code Scams

QR codes offer convenience, but they’ve become a new tool for fraudsters.

- The Trick: Scammers send you a QR code, claiming that scanning it will allow you to receive money (e.g., for selling an item online, or a refund).

- The Reality: In reality, scanning a malicious QR code often initiates a payment from your linked account or installs malware on your device. Alternatively, it might lead to a fake website designed to steal your credentials.

How to avoid: Only scan QR codes from trusted sources. Never scan a QR code to receive money; payments are typically initiated by the sender. Always verify the transaction details before confirming any payment.

10. Deepfake and AI Voice Scams

This is an emerging and highly dangerous threat, leveraging artificial intelligence.

- The Impersonation: Scammers use AI to generate realistic voice clones or deepfake videos of your family members, friends, or even your boss.

- The Deception: They might call you with an urgent plea for money, pretending to be a loved one in distress, or your boss asking for an urgent fund transfer. The voice will sound identical, making it incredibly difficult to detect the fraud. This highlights a growing concern that requires robust enterprise AI risk management.

How to avoid: If you receive such a call, especially with an urgent financial request, try to verify through another channel (e.g., call the person back on their known number, or contact another family member). Establish a “safe word” with close contacts for emergencies.

The rise of deepfake technology means you can no longer solely rely on voice recognition. Always have a pre-arranged ‘safe word’ or verification question with close contacts for emergency situations.

Protecting Yourself: Essential Steps for Digital Safety

While the scams evolve, the core principles of protection remain constant.

- Be Skeptical: If something feels off, or too good to be true, it probably is. Trust your gut.

- Verify, Verify, Verify: Always cross-check information. Call official numbers, visit official websites. Don’t rely on information provided by the potential scammer.

- Never Share OTPs/PINs: Your One-Time Password (OTP) is the key to your accounts. Never share it with anyone, even if they claim to be from your bank or a government agency.

- Strong Passwords & 2FA: Use unique, strong passwords for all your online accounts. Enable two-factor authentication (2FA) wherever possible. This adds an extra layer of security, making it harder for criminals to access your accounts even if they steal your password. For more tips on securing your data, consider reading about data loss prevention (DLP).

- Secure Your Devices: Keep your operating system, browsers, and antivirus software updated. These updates often include critical security patches. If you suspect your device has been compromised by malware due to a scam, follow these 7 malware removal steps to take immediately.

- Beware of Unknown Links/Attachments: Do not click on suspicious links or download attachments from unknown senders. They can lead to malware infections or phishing sites.

- Public Wi-Fi Caution: Avoid conducting financial transactions or sharing sensitive information on public Wi-Fi networks, as they are often unsecured.

- Report Scams: If you fall victim to a scam or encounter one, report it immediately to the National Cybercrime Reporting Portal (cybercrime.gov.in) and your bank. The sooner you report, the higher the chance of recovery.

Your Vigilance is India’s Strength

Cyber scams are a persistent and evolving threat, but they are not unbeatable. The key to safeguarding yourself and your community lies in awareness, skepticism, and proactive digital hygiene. As India continues its journey towards a fully digital economy, every citizen plays a vital role in creating a safer online environment.

Remember, cybercriminals thrive on ignorance and urgency. Take a moment to pause, think, and verify before you click, share, or pay. Share this knowledge with your family and friends, especially the elderly, who are often prime targets for these deceptive schemes. By staying informed and vigilant, we can collectively build a stronger, more secure digital India for 2025 and beyond. Stay safe online!

Leave a comment