Imagine a simple scan, a quick convenience, turning into a nightmare where your bank account is drained, or your personal information is stolen. This isn’t a scene from a futuristic thriller; it’s the harsh reality of “QR Code Scams,” a rapidly evolving menace that security experts are calling “quishing.” As we navigate 2025, QR codes are ubiquitous, facilitating everything from restaurant menus to digital payments, making us increasingly vulnerable to sophisticated QR code fraud. Understanding what is quishing and how to protect yourself from these insidious QR phishing attacks is no longer optional; it’s a critical component of modern mobile security threats and online scam prevention. This comprehensive guide will arm you with the knowledge to identify, avoid, and report these digital payment scams, fostering essential cybercrime awareness in our interconnected world, especially concerning prevalent UPI QR code fraud.

Table of Contents

Key Takeaways

- Quishing is QR Code Phishing: It involves using malicious QR codes to trick users into revealing sensitive information or initiating fraudulent transactions.

- Widespread Threat: QR Code Scams are becoming increasingly sophisticated, appearing in various everyday settings, from fake parking tickets to manipulated restaurant menus.

- Digital Payment Vulnerability: Many quishing attacks specifically target digital payment platforms, including widespread UPI QR code fraud, leading to direct financial losses.

- Vigilance is Key: Always verify the source of a QR code, be wary of unsolicited requests, and scrutinize URLs before entering any personal data.

- Report and Educate: Reporting suspicious QR codes and staying informed are crucial steps in combating these new-age mobile security threats.

Understanding What is Quishing: The Evolution of QR Code Fraud

The term “quishing” is a clever portmanteau, combining “QR” (Quick Response) and “phishing.” Just as traditional phishing scams use deceptive emails or messages to trick victims, quishing employs malicious QR codes to achieve similar nefarious goals. These codes, designed for their convenience and speed, bypass many traditional security checks because users are often in a hurry and assume the source is legitimate.

In 2025, QR codes are everywhere. They are used for:

- Contactless payments

- Accessing digital menus

- Downloading apps

- Checking into events

- Marketing campaigns

- Public information displays

This widespread adoption, while convenient, has created a fertile ground for cybercriminals. The simplicity of scanning a QR code makes it an ideal vector for QR code fraud. Scammers can easily generate malicious codes that, when scanned, redirect users to phishing websites, download malware, or even initiate unauthorized digital payment scams.

The Modus Operandi of Quishing

The core of a quishing attack lies in deception. A scammer replaces a legitimate QR code with a fraudulent one, or places a fake code in an unexpected but believable location. When an unsuspecting user scans this code, they are often led to:

- Fake Login Pages: Websites designed to look identical to legitimate services (e.g., banking portals, social media, email providers) where users are prompted to enter their credentials. Once entered, the data is harvested by the attacker.

- Malware Downloads: Scanning the QR code might trigger the download of malicious software (malware) onto the user’s device, giving attackers control or access to sensitive data. Learn more about malware removal steps if you suspect an infection.

- Unauthorized Transactions: In the context of digital payment scams, particularly UPI QR code fraud, scanning a malicious code might initiate a payment request that, if approved by the user, transfers funds directly to the scammer.

- Phishing for Personal Information: The code might link to surveys or forms designed to collect personally identifiable information (PII) such as names, addresses, phone numbers, or even Aadhaar/Social Security numbers.

The ease with which these codes can be generated and distributed makes them a formidable mobile security threat. Unlike suspicious URLs in emails, which users might scrutinize, a QR code often feels more immediate and trustworthy in a physical setting.

How QR Phishing Attacks Manifest: Common Scenarios of QR Code Scams

QR Code Scams are becoming increasingly sophisticated, evolving to exploit our trust in digital interactions. Here are some prevalent scenarios you might encounter in 2025:

1. Fake Parking Tickets and Payment Stations

Imagine returning to your car to find a parking ticket with a QR code for payment. Many cities are moving towards digital payment options for fines. Scammers exploit this by creating convincing fake tickets with malicious QR codes. When scanned, these codes might direct you to a fraudulent payment portal that steals your credit card details or initiates a transfer via UPI QR code fraud [1].

2. Restaurant Menu Scams

With the pandemic accelerating the adoption of digital menus, QR codes are common on restaurant tables. A scammer might discreetly replace a legitimate QR code sticker with their own, leading diners to a phishing site that looks like the restaurant’s online ordering system. The goal? To capture payment information or even prompt a “tip” that goes directly to the scammer.

3. Public Advertising and Information Boards

QR codes on billboards, bus stops, or public information kiosks can be tampered with. A seemingly innocuous scan for more information about an event or product could lead to a site designed to spread malware or harvest data. Always exercise caution, especially with codes placed in easily accessible public spaces.

4. Digital Payment Scams: The UPI QR Code Fraud Epidemic

This is perhaps one of the most financially damaging types of QR code fraud.

- “Receive Payment” Scams: Scammers send a QR code via messaging apps, claiming it’s to receive a payment (e.g., for an item sold online). However, scanning and approving the transaction actually sends money to the scammer. This is a common tactic in UPI QR code fraud in regions like India, where UPI is widely used.

- Fake Merchant Codes: In small shops or street vendors, a scammer might swap the legitimate merchant’s QR code with their own. Customers, thinking they are paying the vendor, unwittingly send money to the fraudster.

5. Utilities and Bill Payment Scams

You might receive a notification or a physical letter from what appears to be a utility company, warning of disconnection if a bill isn’t paid immediately. These often include a QR code for “quick payment.” Scanning this code invariably leads to a fraudulent site designed to steal your financial information.

6. Social Media and Messaging App Scams

Scammers leverage social engineering tactics on platforms like WhatsApp or Telegram. They might send a QR code claiming it’s for a contest entry, a special discount, or to verify an account. The QR code then leads to a credential harvesting site or a malware download. Maintaining strong cyber hygiene in 2025 is crucial to avoid such traps.

The Psychological Angle of QR Code Fraud

Scammers understand human psychology. They leverage:

- Urgency: “Pay now or face consequences!” (e.g., parking tickets, utility bills).

- Trust: Impersonating trusted brands or institutions (e.g., banks, popular restaurants).

- Curiosity: “Scan to win a prize!” or “Find out more!”

- Convenience: The expectation that a QR code offers a faster, easier way to complete a task.

These factors make us less likely to scrutinize the QR code itself or the destination URL it directs us to, making QR phishing attacks highly effective.

Protecting Yourself: Online Scam Prevention Against Quishing and Mobile Security Threats

{“content”:[“Infographic outlining practical, actionable tips for online scam prevention and protection against QR Code Scams. Visual elements should include symbols for verifying sources, using trusted apps, enabling two-factor authentication, and exercising caution with unsolicited requests. Emphasize mobile security threats and how individuals can fortify their defenses against QR phishing attacks and QR code fraud. Include a checklist format to make the advice easy to digest and remember.”]}

Given the rising tide of QR Code Scams, proactive online scam prevention is paramount. Here’s a robust strategy to protect yourself from quishing, QR code fraud, and other mobile security threats in 2025:

1. Always Verify the Source (The Golden Rule)

Before scanning any QR code, especially in public or unfamiliar settings, take a moment to assess its legitimacy.

- Inspect the physical code: Is it a sticker placed over another code? Does it look tampered with or poorly printed? Is it slightly askew? These are red flags.

- Verify the context: Does the QR code make sense in its current location? If you’re scanning a menu, ensure it’s on the official restaurant table or sign.

- Look for official branding: While scammers often mimic branding, look for any inconsistencies or low-quality graphics.

2. Scrutinize the URL Before Proceeding

Many modern smartphone cameras and QR code scanner apps will display the URL associated with the QR code before navigating to it. This is your critical opportunity to inspect the link.

- Check for HTTPS: Legitimate websites use “https://” for secure connections. Be wary of “http://” for sites requesting sensitive information.

- Examine the domain name: Does it match the expected organization exactly? Scammers often use subtle misspellings (e.g., “bankofamerica.co” instead of “bankofamerica.com”) or long, complex subdomains that hide the true destination.

- Don’t click if suspicious: If the URL looks odd or doesn’t match your expectation, do not proceed.

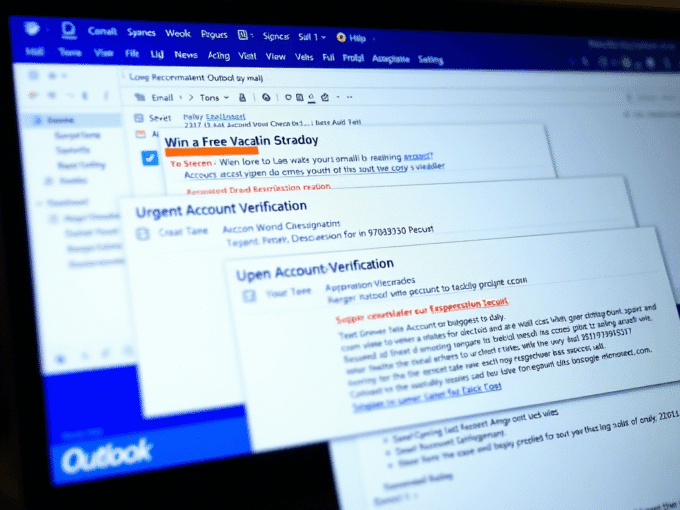

3. Be Wary of Unsolicited QR Codes

Treat unsolicited QR codes with the same suspicion as unsolicited emails or messages.

- Emails/Messages: If you receive an email or message with a QR code, even from a seemingly legitimate sender, be extremely cautious. It’s better to navigate directly to the official website or app rather than scanning a code from an unverified source.

- Social Media: Beware of QR codes posted on social media promising incredible deals or urgent actions. These are often lures for QR phishing attacks.

4. Use Trusted Apps for Payments

When making digital payments, always use official, verified apps (e.g., Google Pay, Apple Pay, your bank’s official app, or the official UPI app).

- Initiate payments directly: Instead of scanning a QR code for payment, if possible, manually enter the merchant’s ID or phone number within your trusted payment app.

- Double-check recipient details: Before confirming any transaction, especially for UPI QR code fraud, always verify the recipient’s name and details shown in your payment app. Never approve a payment request you didn’t initiate to send money, even if it claims to be for receiving money.

5. Enable Two-Factor Authentication (2FA)

While 2FA won’t prevent you from scanning a malicious QR code, it adds a crucial layer of security if your login credentials are stolen. Even if a scammer gets your password via a phishing site, they likely won’t have the second factor (e.g., a code from your phone or an authenticator app) to access your account. This is a foundational element of strong digital security strategies.

6. Keep Your Devices and Software Updated

Regularly update your smartphone’s operating system and all installed apps. These updates often include critical security patches that protect against known vulnerabilities, including those exploited by malware downloaded via QR Code Scams.

7. Install Reputable Security Software

Consider installing a reputable mobile security app on your smartphone. These apps can often detect malicious links or files associated with QR phishing attacks before they cause harm.

8. Educate Yourself and Others on Cybercrime Awareness

The best defense is a well-informed user. Stay updated on the latest cyber threats and share this knowledge with friends and family. Encourage critical thinking before acting on digital prompts. Platforms like CyberTech Journals frequently publish advisories and guides on online scam prevention.

What to Do If You’ve Fallen Victim to a QR Code Scam

Even with the best precautions, sometimes accidents happen. If you suspect you’ve fallen victim to QR code fraud or a QR phishing attack, act immediately:

- Isolate the Device: If you suspect malware was downloaded, disconnect your device from the internet (turn off Wi-Fi and mobile data) to prevent further data exfiltration or remote access.

- Change Passwords: Immediately change passwords for any accounts that may have been compromised (e.g., banking, email, social media). Use strong, unique passwords for each account.

- Contact Your Bank/Payment Provider: If financial information was compromised or unauthorized transactions occurred (especially in digital payment scams or UPI QR code fraud), contact your bank or payment service provider immediately. They can help freeze accounts, reverse fraudulent charges, and provide guidance.

- Run a Security Scan: Use a reputable antivirus or anti-malware scanner on your device to check for and remove any malicious software.

- Report the Incident:

- Law Enforcement: Report the scam to your local police or cybercrime unit. Provide them with all available details, including screenshots, transaction IDs, and the location of the malicious QR code if known.

- Relevant Authorities: Depending on your region, report to consumer protection agencies or cybersecurity incident response teams. For example, in India, you can report UPI QR code fraud to the National Cybercrime Reporting Portal.

- Platform Providers: If the scam involved a specific platform (e.g., a social media site, a digital wallet app), report the fraudulent activity to them.

Remember, time is of the essence when dealing with cybercrime. The faster you react, the better your chances of mitigating damage and recovering lost assets. Understanding how to prepare for a cyber attack is crucial for swift action.

The Broader Landscape: Cybercrime Awareness and the Future of Mobile Security Threats

{“content”:[“Conceptual scene showing law enforcement or cybersecurity experts actively working to combat QR Code Scams and digital payment scams. Include elements of digital forensics, data analysis, and international collaboration to illustrate the broader fight against QR code fraud. The setting should convey a high-tech environment with screens displaying threat intelligence and real-time monitoring, emphasizing the ongoing efforts in cybercrime awareness and online scam prevention.”]}

The rise of QR Code Scams underscores a critical shift in the cyber threat landscape. As our lives become increasingly digital, cybercriminals will continue to exploit new technologies and human trust. Quishing is just one example of how common tools can be weaponized.

In 2025, mobile security threats are a top concern for individuals and businesses alike. Our smartphones are essentially mini-computers holding immense amounts of personal and financial data. Protecting these devices from QR code fraud, phishing, and malware is paramount.

The Role of Technology and Policy

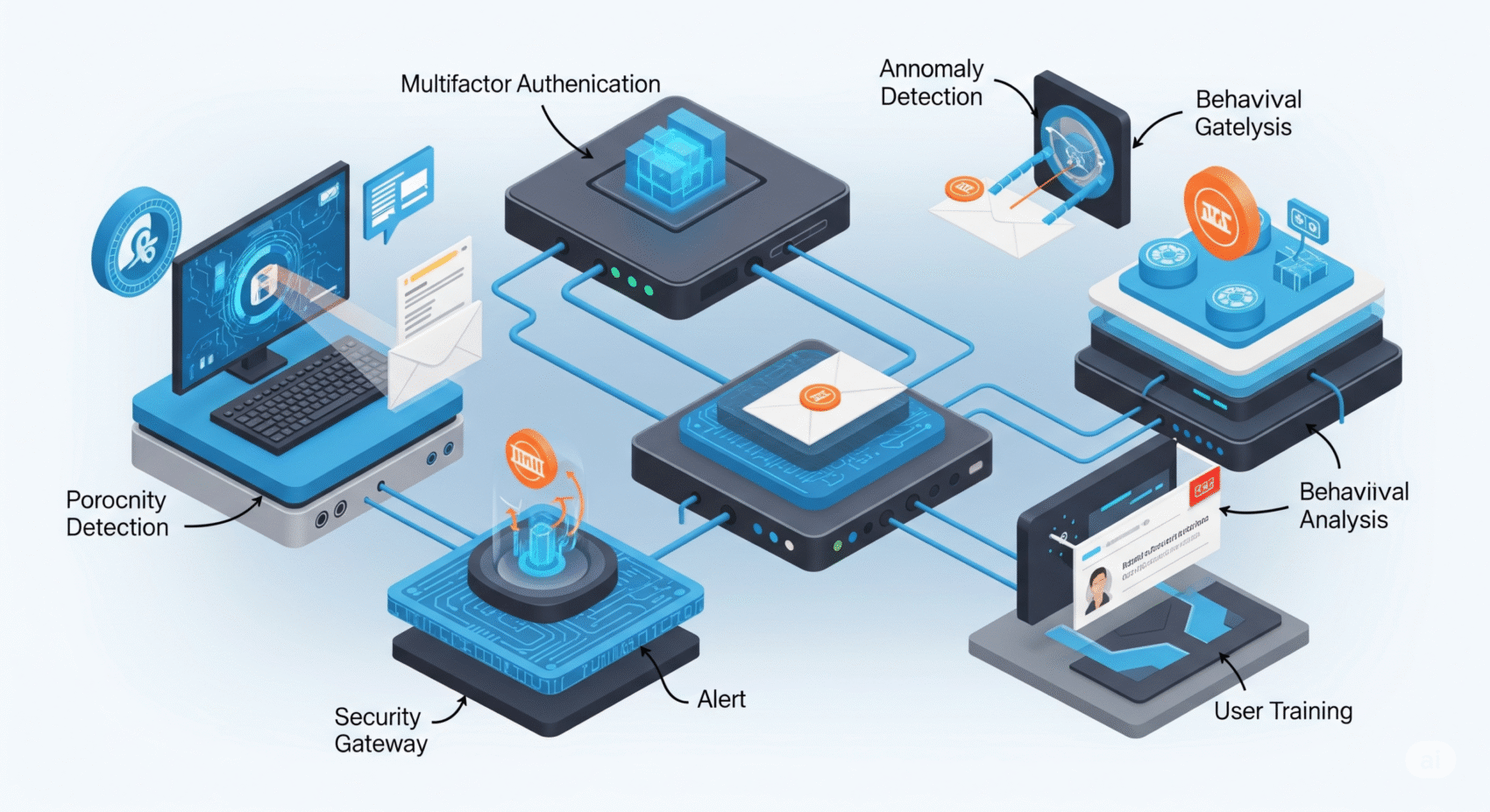

While individual vigilance is crucial, technology and policy also play vital roles in combating QR Code Scams:

- Enhanced Scanner Apps: Future QR code scanner apps might incorporate more robust security features, such as real-time URL analysis and warnings for suspicious domains.

- AI-driven Threat Detection: Artificial intelligence is being deployed to identify and flag malicious QR codes and associated phishing sites more quickly [2]. Organizations and businesses can leverage AI threat detection tools that actually work to bolster their defenses.

- Industry Collaboration: Banks, payment providers, and tech companies are increasingly collaborating to share threat intelligence and develop joint strategies against digital payment scams and UPI QR code fraud.

- Public Awareness Campaigns: Governments and cybersecurity organizations are launching campaigns to educate the public about these new-age digital traps, boosting cybercrime awareness.

For businesses, integrating comprehensive cybersecurity for businesses that includes employee training on quishing is non-negotiable. Employees who use QR codes for work-related tasks, especially in finance or logistics, must be particularly aware of these risks.

Looking Ahead

As we move deeper into 2025, the sophistication of QR phishing attacks will likely increase. We might see:

- Deepfake-enhanced quishing: QR codes leading to sites with deepfake videos or audio to convince victims of legitimacy.

- Localized, hyper-targeted attacks: Scammers leveraging local events, businesses, and cultural nuances to make their QR code fraud more convincing.

- Integration with other attack vectors: Quishing combined with smishing (SMS phishing) or vishing (voice phishing) for multi-channel attacks.

Staying informed, cautious, and proactive are the best tools in our arsenal against these evolving threats. Our journey into digital convenience must be matched by an equal commitment to digital security.

Conclusion: Scan Smart, Not Blindly

QR Code Scams, or quishing, represent a significant new-age digital trap that demands our attention in 2025. What was once a simple convenience has become a powerful vector for QR code fraud, digital payment scams, and severe mobile security threats. From subtle sticker overlays on legitimate QR codes to convincing fake parking tickets and widespread UPI QR code fraud, cybercriminals are constantly finding new ways to exploit our trust and eagerness for quick solutions.

The key to online scam prevention against these sophisticated QR phishing attacks lies in a combination of heightened cybercrime awareness, vigilance, and proactive security measures. Remember to always question the legitimacy of a QR code, especially in unfamiliar contexts. Take that extra second to inspect the code for tampering, preview the URL it directs you to, and be suspicious of any urgent or too-good-to-be-true requests. Use official apps for transactions and enable multi-factor authentication whenever possible.

If you suspect you’ve been a victim, act swiftly: secure your accounts, inform your bank, and report the incident to the authorities. By empowering ourselves with knowledge and adopting a security-first mindset, we can collectively build a stronger defense against the evolving landscape of digital threats and ensure our digital interactions remain safe and secure. Stay safe, stay smart, and always scan with caution.

1. What is quishing?

Quishing is a cyber scam where attackers use malicious QR codes to steal money, data, or install malware.oes “quishing” mean?

2. Are QR code scams common in India?

Yes. QR-based UPI scams are increasing rapidly across retail shops, parking areas, and fake utility payment portals.

3. Can QR codes contain malware?

Yes. QR codes can redirect users to malicious sites that install spyware or banking trojans.

4. How do I verify a safe QR code?

Check the URL after scanning, verify branding, avoid shortened links, and never enter OTP or passwords.

5. What should I do if I accidentally pay a scam QR code?

Immediately contact your bank, block UPI, scan your device, change passwords, and file a cybercrime report.

Leave a comment