It’s no secret that businesses today rely heavily on other companies, called “third parties” or “vendors,” to get things done. From cloud storage providers to cleaning services, these partners help your business run smoothly. However, with these partnerships comes a significant responsibility: ensuring they don’t inadvertently or intentionally put your business at risk. This is where Third Party Risk Assessment comes in, especially the important step of vendor due diligence.

Imagine your business is a strong castle. You’ve built high walls and have guards at every gate. But what if a trusted friend brings supplies through a hidden tunnel? If that friend isn’t careful, they could leave the tunnel open for invaders. In the business world, your vendors are like those trusted friends, and their weaknesses can become your weaknesses. That’s why carefully checking them out is super important!

Table of Contents

Key Insights

- Third-party risk assessment is about finding, checking, and managing the dangers that come from working with other companies (vendors).

- Vendor due diligence is the process of thoroughly checking a vendor before you start working with them and continuing to monitor them.

- Ignoring vendor risks can lead to data breaches, legal trouble, lost money, and damage to your reputation.

- A good due diligence process involves steps like categorizing vendors, collecting information, assessing risks, using strong contracts, and ongoing monitoring.

- Staying ahead of risks means being proactive, using technology, and keeping communication open with your vendors.

What is Third Party Risk Assessment?

Third-party risk assessment (TPRA) is a fancy way of saying “checking out the dangers that come from working with other companies.” These “third parties” can be anyone your business works with but doesn’t directly own. Think of them as your business partners or helpers.

Who are these third parties? They can include:

- Software providers: Like the company that hosts your website or manages your customer emails. 📧

- Cloud service providers: Companies that store your data online.

- Consultants: Experts you hire for specific tasks.

- Manufacturers or suppliers: Companies that make or provide the products you sell.

- Payment processors: Services that handle your customer’s credit card payments.

The “risk assessment” part means figuring out what could go wrong, how likely it is to happen, and how bad it would be if it did. For third parties, these risks can be many things:

- Cybersecurity Risks: A vendor’s weak security could lead to your data being stolen.

- Operational Risks: If a vendor can’t deliver their service, your business might stop working.

- Financial Risks: A vendor going out of business could cause problems for you.

- Compliance Risks: If a vendor doesn’t follow laws (like data privacy rules), you could get in trouble.

- Reputational Risks: If a vendor does something bad, your customers might lose trust in your company.

Understanding information security is a big part of dealing with these risks. It helps you protect your valuable data and systems, even when they’re handled by others. Learn more about understanding information security and its role in cybersecurity.

Why is Vendor Due Diligence So Important?

You might think, “Why bother with all this checking? I trust my vendors!” But in today’s digital world, trust isn’t enough. Many big data breaches and cyberattacks don’t happen because a company’s own security was bad. They happen because one of their vendors had a weakness.

Consider this:

Your weakest link is often outside your walls. A vendor’s security gap can become your security nightmare.

Here’s why vendor due diligence is a must-do:

- Protecting Your Data: Many vendors handle your sensitive information, like customer details or financial records. If their security isn’t strong, that data could be stolen, leading to huge problems.

- Avoiding Legal Trouble: Laws like GDPR (in Europe) or HIPAA (for healthcare in the US) hold your company responsible for how your vendors handle data. If they mess up, you could face big fines.

- Keeping Business Running Smoothly: If a key vendor has an outage or a problem, it can stop your operations cold. Due diligence helps ensure they have good plans in place.

- Saving Money: A data breach or service disruption can cost millions in recovery, legal fees, and lost business. Preventing it is far cheaper.

- Protecting Your Reputation: Customers trust you with their information. If a vendor causes a breach, that trust is broken, and it can take years to rebuild.

Real-world events, like the ICBC Bank ransomware attack, show just how disruptive and costly cyberattacks can be, impacting not just the primary target but also interconnected systems and partners.

The Vendor Due Diligence Process: A Step-by-Step Guide

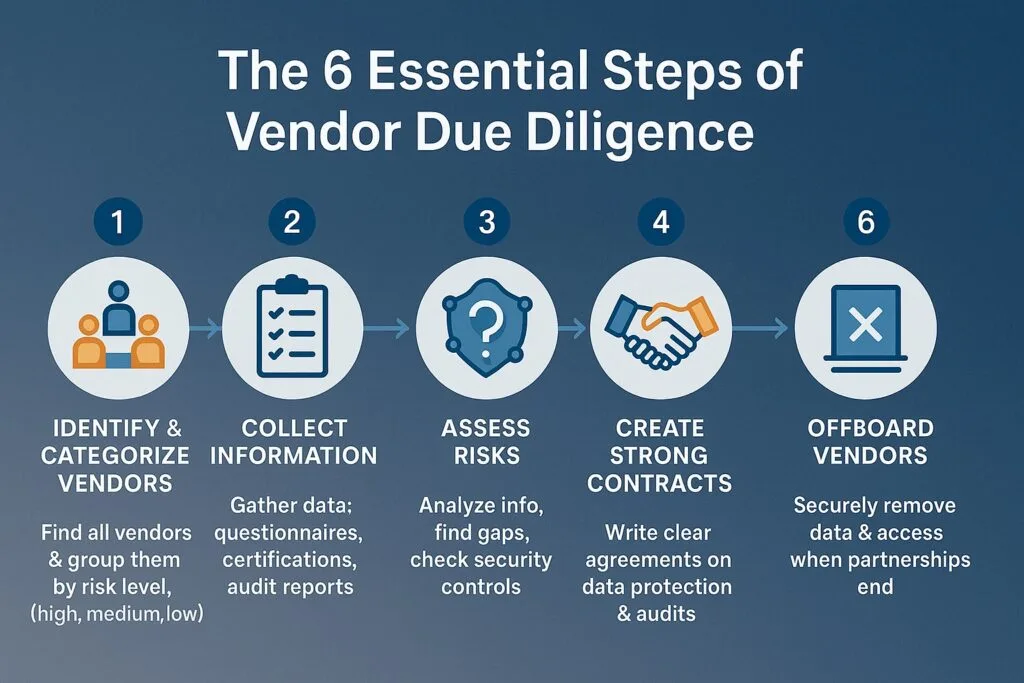

Vendor due diligence isn’t a one-time thing; it’s a continuous journey. Here are the key steps involved:

Step 1: Identify and Categorize Your Vendors

Not all vendors are created equal. A company that cleans your office has different risks than one that stores all your customer data.

- List them all: Make a complete list of every third party you work with.

- Categorize by risk: Group them based on the type of data they handle, the services they provide, and how critical they are to your business.

- High-risk: Handle sensitive customer data, financial info, or are critical to core business functions. These need the deepest checks.

- Medium-risk: Access some non-sensitive data or provide important but not critical services.

- Low-risk: Provide basic services with no access to sensitive data.

Step 2: Collect Information from Vendors

Once you know who your vendors are and their risk level, it’s time to gather details.

- Questionnaires: Send them detailed questions about their security practices, policies, and procedures.

- Certifications: Ask for proof of security certifications like SOC 2, ISO 27001, or NIST. These show they meet certain security standards.

- Audits and Reports: Request copies of their recent audit reports or penetration test results.

- Financial Health: For critical vendors, check their financial stability to ensure they’re not about to go out of business.

Step 3: Assess the Risks

This is where you review all the information you’ve gathered to find any weak spots.

- Review Responses: Go through their answers and documents carefully. Do their security controls match your expectations?

- Identify Gaps: Look for areas where their security might not be strong enough. For example, do they have a plan for what to do if they get hacked?

- Evaluate Controls: Are their security measures (like firewalls, encryption, employee training) good enough to protect your data?

- Cybersecurity Deep Dive: For high-risk vendors, you might even perform or request:

- Vulnerability scans: Looking for known weaknesses in their systems.

- Penetration tests: Trying to hack into their systems (with permission!) to find unknown weaknesses.

- Incident Response Plans: Do they have a clear plan for how they’d handle a data breach and notify you?

Keeping up with the latest threats, like understanding a specific Fortinet zero-day vulnerability, helps you ask the right questions about a vendor’s ability to protect against new attacks. This is also where the role of a CISO (Chief Information Security Officer) becomes vital, as they need to understand how AI impacts their role and the overall security landscape.

Step 4: Create Strong Contracts

Your contract isn’t just about what services they’ll provide. It’s also about security and risk.

- Data Protection Clauses: Include clear rules on how they must protect your data, how long they can keep it, and what happens if there’s a breach.

- Right to Audit: Make sure you have the right to audit their security practices if needed.

- Service Level Agreements (SLAs): Define how quickly they must respond to incidents or fix problems.

- Liability: Clarify who is responsible if something goes wrong.

Step 5: Ongoing Monitoring

Risks don’t stay still! A vendor that was safe yesterday might have new risks today.

- Regular Re-assessments: Re-evaluate high-risk vendors annually or even more often.

- Performance Reviews: Check that they are meeting their contractual obligations, especially related to security.

- Threat Intelligence: Keep an eye on new cyber threats that might affect your vendors.

- Alerts: Set up alerts for news about your vendors, like mergers, acquisitions, or security incidents.

Step 6: Offboarding Vendors

When you stop working with a vendor, you need to make sure all your data is securely returned or destroyed.

- Data Retrieval/Deletion: Ensure they delete all your data from their systems and provide proof.

- Access Revocation: Make sure all their access to your systems is removed.

Common Challenges in Third-Party Risk Assessment

While crucial, this process isn’t always easy. Here are some hurdles businesses often face:

- Too Many Vendors: Large companies can work with thousands of vendors, making it tough to check every single one thoroughly.

- Lack of Resources: It takes time, money, and skilled people to do proper assessments. Many businesses don’t have enough of these.

- Getting Good Information: Vendors might be slow to respond, or they might not provide complete or accurate information.

- Keeping Up with Changes: The world of cyber threats and regulations changes fast. It’s hard to stay on top of everything.

- Vendor Fatigue: Vendors get many requests for information from all their clients, leading to them being slow or less thorough in their responses.

Sometimes, even a vendor’s internal processes or employee training can expose them to risks, such as falling victim to scams like fake job offers, which can then open doors for attackers.

Best Practices for Robust Vendor Due Diligence

To make your third-party risk assessment truly effective, consider these best practices:

- Start Early: Begin due diligence before you even sign a contract with a new vendor. It’s much harder to fix problems later.

- Automate What You Can: Use special software to help manage vendor information, send questionnaires, and track risks. This saves a lot of time and effort.

- Define Roles Clearly: Make sure everyone knows who is responsible for what part of the assessment process.

- Communicate Openly: Work with your vendors, not against them. Explain why you need certain information and offer to help them understand your requirements.

- Train Your Team: Make sure your internal team understands the importance of third-party risk and how to identify potential issues.

- Have an Incident Response Plan: What will you do if a vendor does have a breach? Have a clear plan for communication, containment, and recovery.

Final Thought

In today’s interconnected business world, your company’s security is only as strong as your weakest link. And often, that weakest link can be a third-party vendor. A strong third party risk assessment program, built on thorough vendor due diligence requirements, isn’t just a good idea—it’s absolutely essential. By carefully checking your partners, understanding their risks, and continuously monitoring them, you can protect your data, your reputation, and your bottom line. It’s about building a strong, secure network of trusted partners that helps your business thrive, not just survive.

Leave a comment